In this article we show the danger of using hedge fund indices as benchmarks for liquid alts. Our analysis shows that hedge fund indices are all third cousins. So, even for these clusters, it would be like comparing the members of an immediate family to a third cousin certainly there are similarities, but a second cousin or an uncle would be a better benchmark.

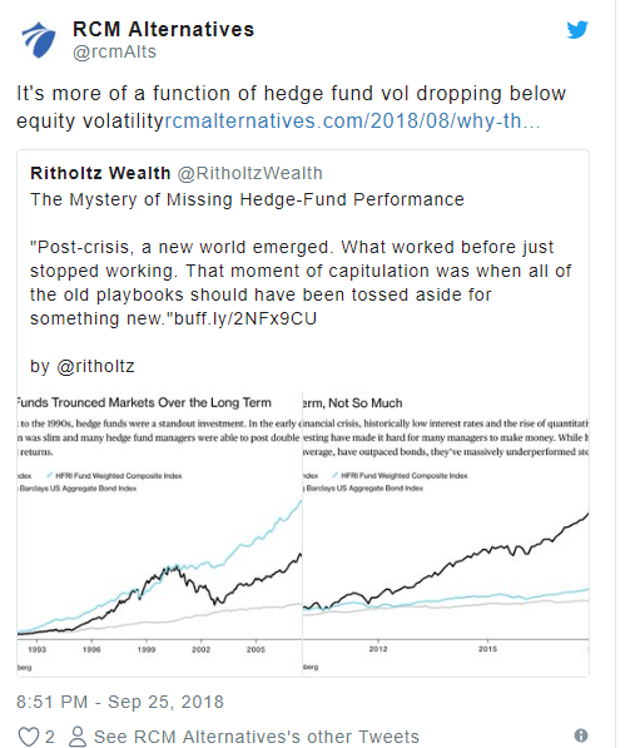

The hedge fund benchmarks are very “distant” from the funds in the group, meaning the performance of the hedge fund index is very distant from the performance of the funds in the group. There is a caveat to this statement, however. The results of our analysis show that at best, half of all the absolute return, equity market-neutral, and multi-strategy hedge funds could possibly use hedge fund indices as benchmarks. To form these groups we use a simple tool called cluster analysis. If we are successful in forming a meaningful group that includes the benchmark, the various observations about each member of the group are similar to the others with respect to the variables or attributes of interest. By closeness we mean that a meaningful group that includes the benchmark within the group of funds can be formed. When we compare hedge fund indices to comparable liquid alts (such as absolute return hedge funds and absolute return funds), no significant correlation appears between the indices and funds except in a few rare cases.Īnother factor Lipper considers when selecting a benchmark is the “closeness” of the benchmark to the fund. By “track” we mean the correlation between the benchmark and the fund needs to be no less than 0.6 over a sustained period, typically one to two years. We now show that the impact (or impacts) of these factors can be substantial.Īt Lipper a fund’s benchmark is meant–at a minimum–to track the fund’s performance. Now, some may question the degree of impact of the illiquidity and leverage factors on the use of hedge fund indices as benchmarks. This means that from an economic standpoint the use of hedge fund indices as benchmarks for liquid alts is flawed. Therefore, from an apples-to-apples standpoint the performance of hedge funds includes two factors that liquid alts do not have–the impact of any illiquid investments and the impact of leverage. Nor can they generate beta-like returns from exposure to illiquid investments. With leverage being so limited, liquid alts have a difficult time generating significant alpha, since they cannot lever up their existing alpha like their hedge fund brothers can. However, given the Investment Company Act of 1940 requirements that liquid alternatives operate under, in particular the limited use of leverage and the requirement to provide daily liquidity, liquid alternatives cannot invest in illiquid investments (except in very small amounts) and their use of leverage is severely limited. This is true, and–as are many hedge funds–liquid alternatives are mainly providers of beta and not necessarily providers of alpha. This article shows the problems that arise from this approach.Ī common rationale given for using hedge fund indices is that liquid alternatives often use hedge fund-like strategies. Given the current lack of agreed-upon benchmarks for liquid alternatives funds, many analysts are turning to hedge fund indices as substitutes.

0 kommentar(er)

0 kommentar(er)